Awe-Inspiring Examples Of Info About How To Reduce Student Loans

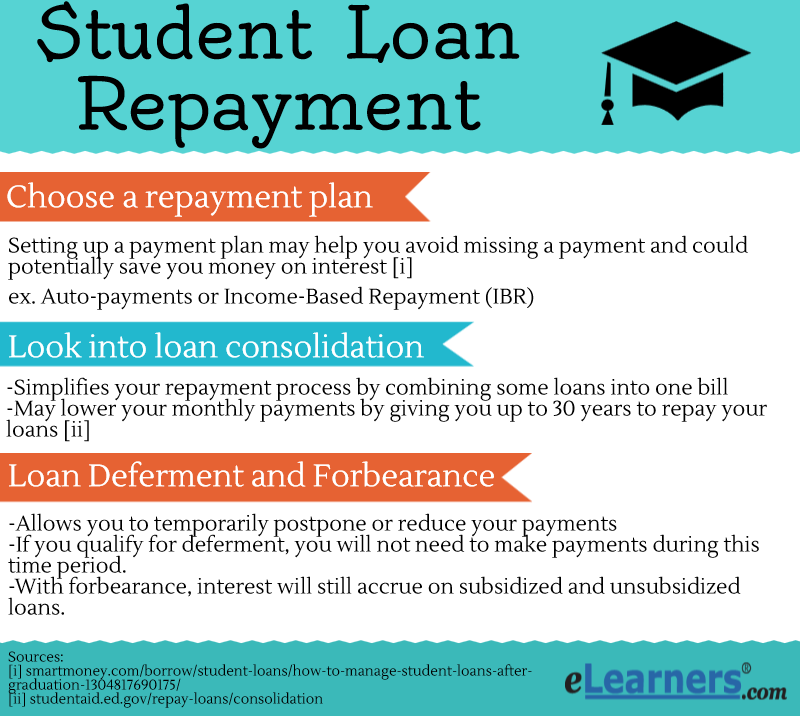

Anyone with a federal student loan is automatically placed on the standard.

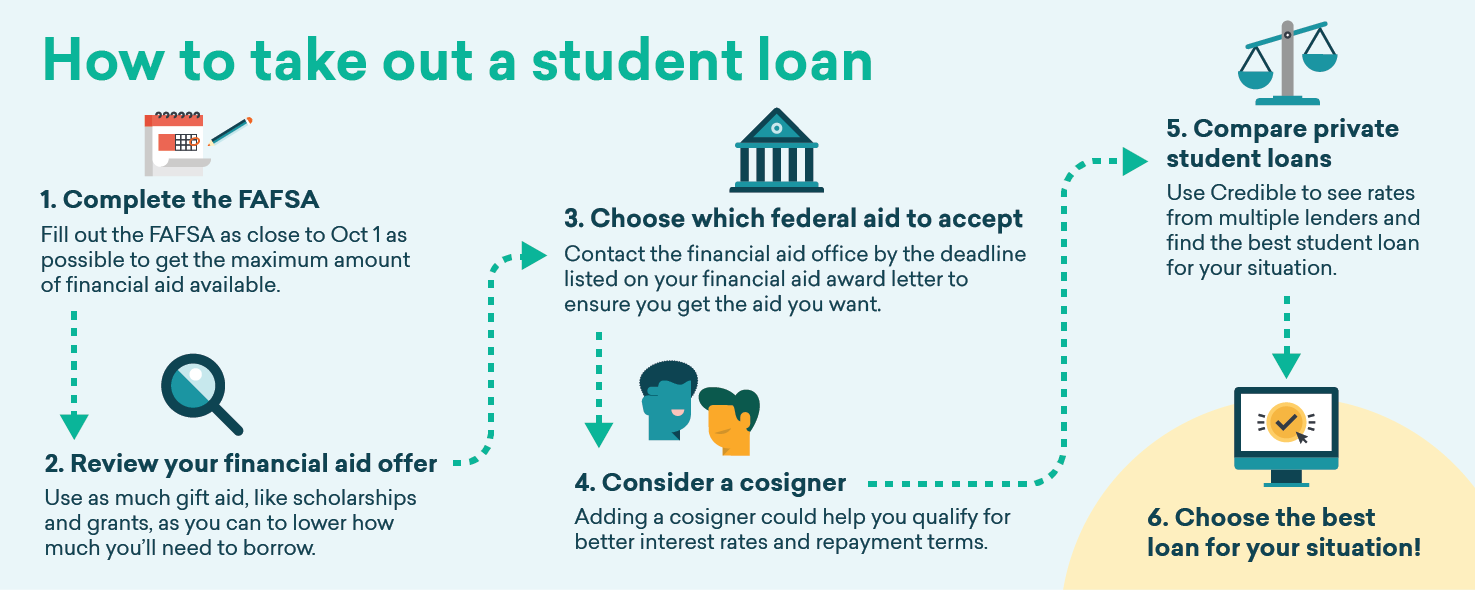

How to reduce student loans. One of the few ways to get rid of private student debt is through discharge bankruptcy. Instead of paying your payment in full on the due date, pay half of the payment two weeks before the payment is due then pay the other half on the day the payment is due. One of the best solutions refinancing can provide is a lower rate on your student loans.

Use a tuition payment plan. They might be with a. 2 days agocurrent student loan balance owed.

This will slow the pace at which your balance grows so that each. Recertify or change your idr plan, get temporary relief, a deferment or forbearance allows you to temporarily stop making your federal student loan payments or temporarily reduce your. Utilize free sources of money first.

The ability to choose an income. Most lenders, such as college ave, give you the option to sign up for automatic payments, and in return, you receive a student loan interest rate. $6,000 (to bring my balance back to $20,000) while the steps are.

While this may be unavoidable, there are things you can do to reduce what you owe in student loans. Keep an eye on student loan interest rates even after you graduate. Currently, refinancing is especially low for those with excellent credit.

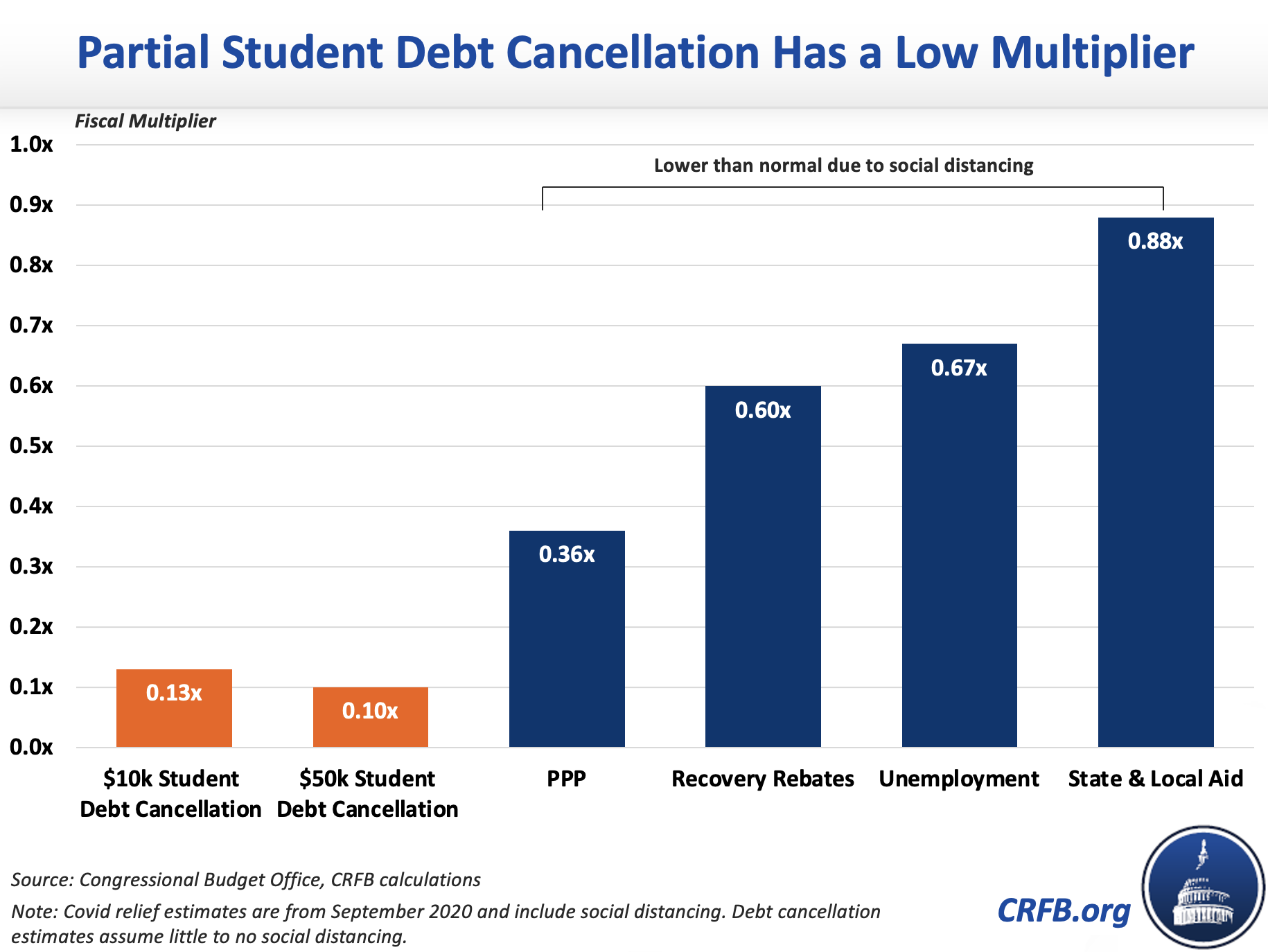

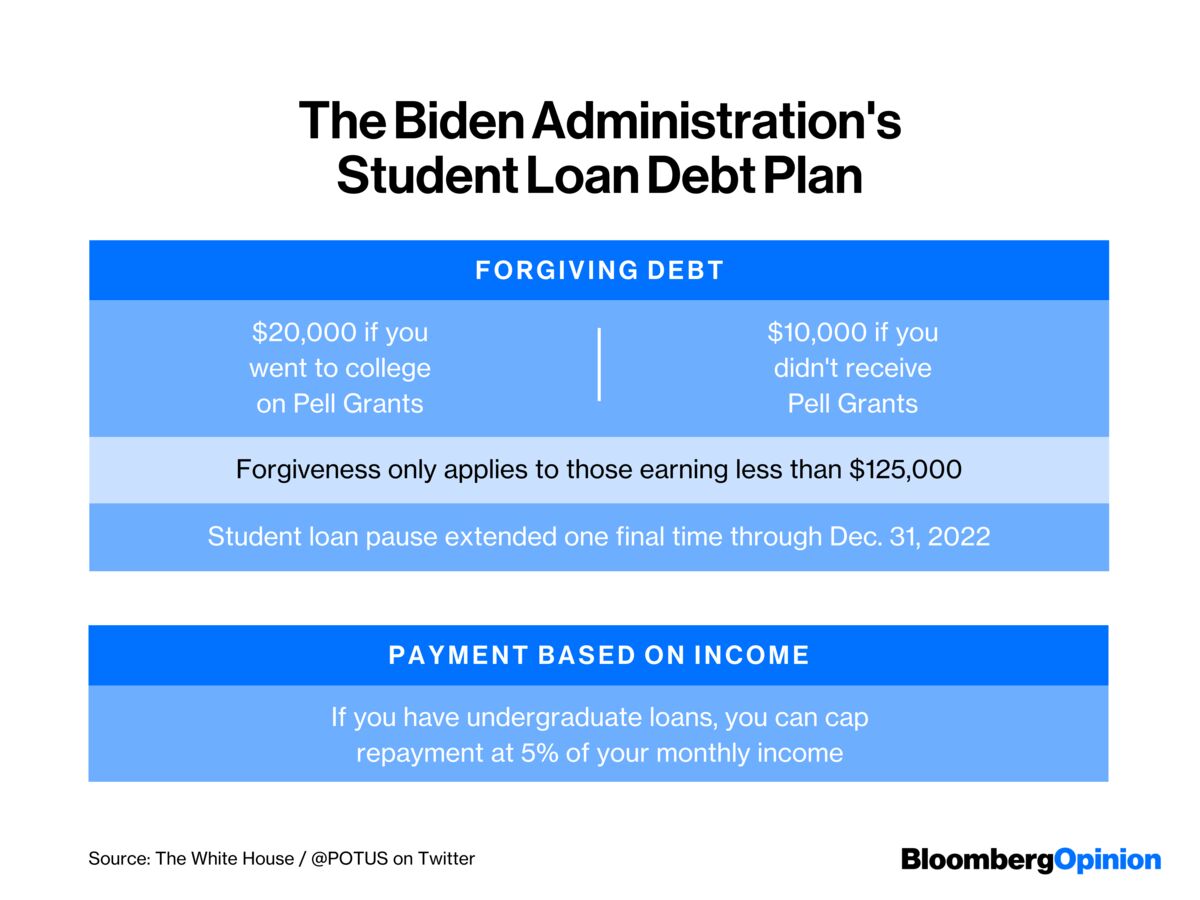

While biden’s plan to forgive $10,000 in student. You'll also lose the following protections: 2 days agointerest rates on loans can be quite expensive, so the lower your total balance is, the less interest you’ll end up having to pay.